IAIC Market Update - February 8, 2021

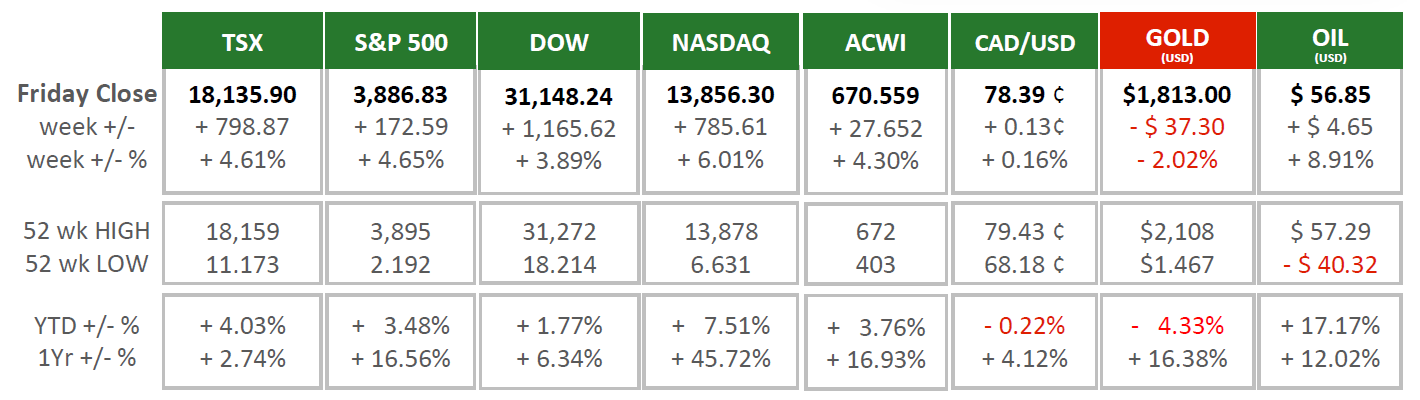

Last Week in the Markets: February 1st - 5th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Overall, it was a positive week for equity markets:

- The major North American indices and the All-Country World Index (ACWI) were all in positive territory

- The ACWI, TSX and the S&P 500 reached new all-time highs. The performance for last week pulled the indices out of negative territory for 2021 Year-to-Date (YTD), except the NASDAQ which was already positive for the year.

- The advances were broad based, especially on the TSX and S&P 500 where every sector made positive contributions.

- Most of last week’s success relied upon progress in Washington toward a stimulus package. The alignment of the House of Representatives, the Senate and the Presidency to Democrat-control has made passing resolutions and legislations easier.

- In the U.S., employment growth slowed with only 49,000 jobs added in January. The unemployment rate is 6.3% with 10.1 million unemployed, well above their pre-pandemic levels in February 2020 (3.5% and 5.7 million, respectively). In Canada, employment fell by 213,000 in January pushing the unemployment rate to 9.4%, which is the highest rate since August 2020. (Source1, Source2)

What’s ahead for this week?

- In Canada, corporate earnings season continues with many firms reporting their latest results as we approach a new federal government budget announcement.

- In the U.S., stimulus legislation talks continue. Positive progress toward enacting legislation may cause markets to post further gains, if passed.

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.