IAIC Market Update - February 22, 2021

Last Week in the Markets: February 16th - 19th, 2021

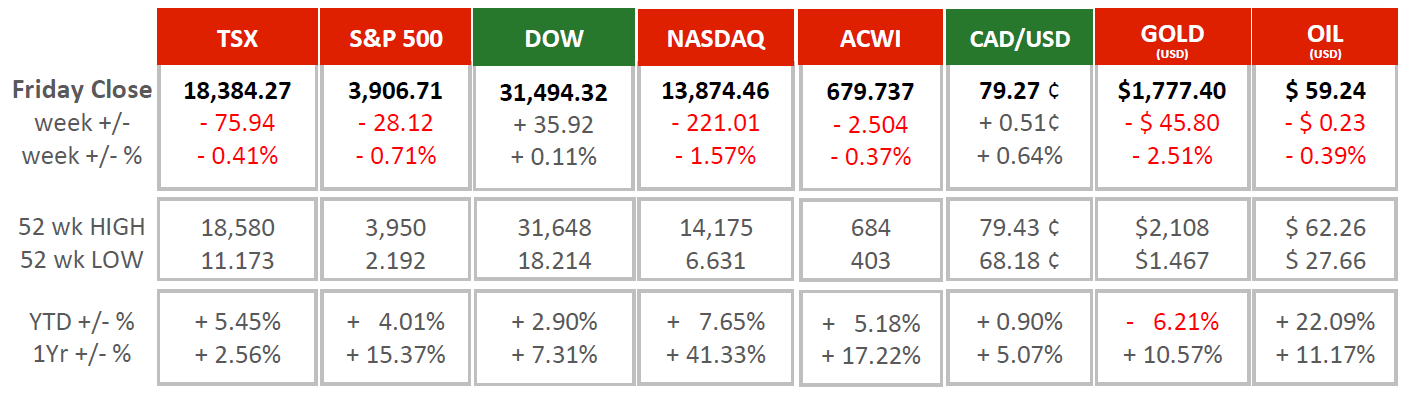

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Most global indices finished the week below where they started, with the Dow being a notable exception. The TSX, S&P 500, and NASDAQ finished the week lower after reaching new all-time highs on Tuesday.

- Vaccine distribution (or at least news of increased production and distribution) contributed to early gains last week. Equities have been very responsive, both positively and negatively, to COVID-19 news and are not expected to lose their correlation soon.

- Canada’s Consumer Price Index (CPI) had its largest monthly increase in about a year, which was driven by the prices of durable goods and gasoline. The U.S. Producer Price Index (PPI) also rose at higher levels than recently seen.

- Both indices have moved closer to the long-standing target inflation rate of 2%. The Federal Reserve and Bank of Canada have indicated that they will begin raising interest rates once an average of 2% inflation is reached. The fear is that growth would need to be trimmed to control inflation before economic recovery is fully achieved. Rates are at the bottom of their effective range, and with inflation growing, rates may eventually rise. (Source1, Source2, Source3)

What’s ahead for this week?

- In Canada, it will be a relatively light week for economic data announcements with employment data for December the lone major event on the calendar. The major Canadian banks will release their most recent quarterly performance. Since these stocks are so widely held, their results are meaningful to almost every Canadian investor.

- In the U.S., January’s new home sales and pending sales, consumer spending and income, and durable goods orders will be released.

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.