IAIC Market Update - February 14, 2022

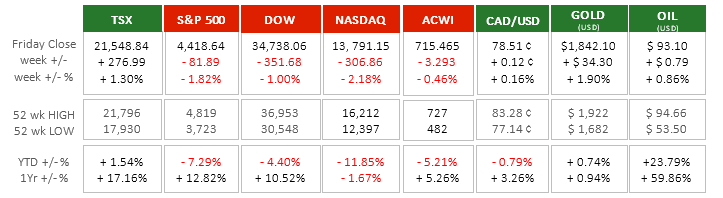

Last Week in the Markets: February 7th - 11th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Prior to the last week’s announcement, inflation expectations have been heavily influencing capital markets. After the announcement from the Bureau of Labour Statistics, inflation continued to dominate market influences. Year-over-year U.S. consumer inflation exceeded most analysts’ predictions and grew by 0.6% in January to 7.5%. Prices rose 0.5% in December.

- Overall, U.S. consumer inflation sits at its highest level in forty years. Core inflation, which does not include the two most volatile consumer categories, food and energy, grew by 0.6% to 6.0%. Supply chain interruptions and disruptions can no longer be blamed entirely for inflation as increases have moved to housing, rents, food, and electricity, which have a services and domestic bias. Consequently, inflation will persist beyond supply chain easing and test the Federal Reserve’s already strained patience. (Source)

- Inflation is rising as Gross Domestic Product (GDP), grows at above-average speed. Real wages continue to do so as well.

- All of this data increases the expectation for interest rate increases from both the Federal Reserve and the Bank of Canada. Typically, rate increases are ¼%, but speculation is increasing that the initial increase could be ½%.

- These monetary policy moves will temper equities, which are already suffering in 2022 from the speculation that increasing and high inflation will lead to interest rate hikes.

What’s ahead for this week?

- In Canada, December’s retail sales, wholesale trade and international securities transactions, and January’s housing starts, existing home sales, MLS Home Price Index, manufacturing sales and new orders will be released. The latest inflation numbers through the CPI will be announced on Wednesday.

- In the U.S., a number of economic indicators, including retail sales, import prices, industrial production, business inventories, housing starts, and building permits, are scheduled for release.

- Globally, Japan’s real GDP, trade deficit and CPI, China’s Consumer and Producer Price Indexes, Eurozone industrial production and consumer confidence will be announced.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.