IAIC Market Update - December 6, 2021

Last Week in the Markets: November 29th - December 3rd, 2021

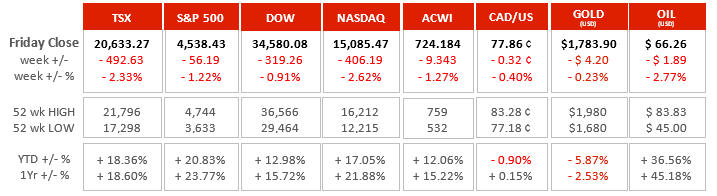

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was an extremely difficult week for markets with equity indices in Canada, the U.S. and globally falling along with the Canadian dollar, gold and oil.

- Positive news on the jobs front suggests that the Bank of Canada and the Federal Reserve may act more quickly to raise interest rates to reign-in inflation. Fears of an economic slowdown associated with higher rates was bolstered by uncertainty of the Omicron variant, which has caused several countries to enact restrictions.

- The latest jobs data was released with 154,000 jobs added in Canada. The unemployment rate fell again by 0.7% to 6.0%. Employment exceeds the February 2020 level by 186,000 jobs and the unemployment is just 0.3% below its level at that time. Total hours worked increased by 0.7% and have returned to pre-pandemic levels. The ending of support programs in Canada was seen as a contributor as more individuals sought to move to earned income. More than 80% of women aged 25 to 54 were employed in November, which is the highest level since the data was first collected in 1976, with growth spread across multiple industries. By comparison 87% of men of the same age are employed, exceeding February levels by 0.5%. (Source1, Source2, Source3)

- In the U.S., 210,000 new jobs were added in November and the unemployment rate fell by 0.4% to 4.2%. “Notable job gains occurred in professional and business service, transportation and warehousing, construction and manufacturing. Employment in retail trade declined over the month” according to the report released by the Bureau of Labor Statistics.

What’s ahead for this week?

- In Canada, merchandise trade balance and third quarter capacity utilization will be announced. The most important update of the week will be the latest release of the Bank of Canada’s monetary policy.

- In the U.S., third quarter productivity, October’s goods and services trade deficit and consumer credit, and November’s Consumer Price Index (CPI) will be released.

- Globally, China’s trade surplus, CPI and producer inflation, Germany’s factory orders and CPI, industrial production will be announced along with Eurozone real Gross Domestic Product.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.