IAIC Market Update - December 20, 2021

Last Week in the Markets: December 13th - 17th, 2021

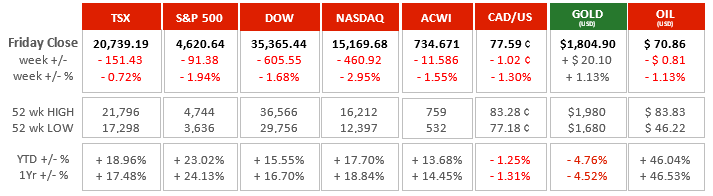

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a difficult week for investors focused on equities with major indices losing between 1% to 3%. Canadians may have suffered the smallest loss in share values, but the Canadian dollar’s 1.3% fall dropped domestic investor losses down to the level experienced for American denominated investors. Inflation and monetary policy news, particularly from the U.S., drove last week’s markets.

- The Canadian annual inflation rate in November equalled the consumer price increases of October at 4.7%. The month-to-month increase dropped to 0.2% from 0.7% experience a month earlier, which is encouraging news. Unfortunately, essentials that are difficult to economise, like food, shelter, energy (including electricity, gasoline, and natural gas), led the way on price increases. On December 8th, the Bank of Canada indicated in its monetary policy announcement that interest rate increases were anticipated in 2022 to combat inflation. (Source1, Source2)

- In the U.S., the Federal Reserve held meetings to discuss and announce their latest monetary policy measures. With Gross Domestic Product (GDP) approaching pre-pandemic levels, unemployment lowering again and nearing 4%, real wages increasing by more than 4% and consumer inflation running at 6.8%, the Fed is compelled to act. Of its dual mandates, maximizing employment and price stability, addressing the historically high consumer price increases is the priority. Jerome Powell, Fed Chair, announced on December 15th that it will lower the bond buying program more quickly than previously announced. Bond buying lowers long-term borrowing costs. He also indicated that short term rates could be increased as many as three times in 2022. (Source1,

Source2,

Source3)

What’s ahead for this week?

- In Canada, October’s retail sales and real Gross Domestic Product will be released in a light week for economic announcements. The TSX will close early on December 24th and will reopen on December 29th.

- In the U.S., the leading indicator, personal spending and income, durable goods orders, new and existing home sales for November, are scheduled, along with third quarter Gross Domestic Product. On Friday, December 24th, U.S. markets will be closed, and will reopen on Monday, December 27th.

- Globally, the data of note includes the Eurozone and German consumer confidence, Japanese department store sales, machine tool orders and Consumer Price Index, in a light week for economic releases around the world.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.