IAIC Market Update - December 19, 2022

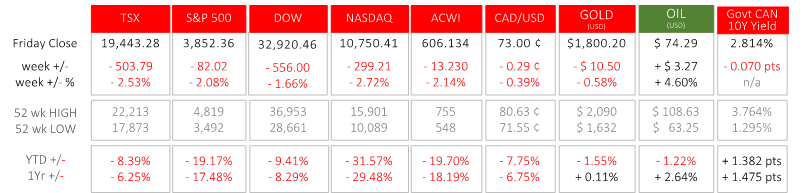

Last Week in the Markets: December 12th – 16th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- For two consecutive weeks, monetary policy announcements influenced North American equity markets. On December 7th the Bank of Canada increased its overnight rate by ½% (50 basis points), and on December 14th the U.S. Federal Reserve increased its benchmark rate, the federal funds rate, by the same amount. The central banks of both countries have increased interest rates at their last seven consecutive opportunities. Also, both institutions have raised their rates by 4¼% since March 2022.

- At least one important difference has emerged. The Bank of Canada has said that future interest rate increases may not be necessary, while the Federal Reserve is anticipating additional increases to control inflation which is well above both of their targets of 2%. The Bank of Canada stated, “. . . Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target”, while the Fed said, “The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” (BoC statement, Fed Statement)

- On December 15th, the European Central Bank (ECB) raised its rates with an identical 50 basis point increase. The ECB’s equivalent to the Canadian overnight and the American federal funds rate is the deposit facility rate and is now 2.0%, less than half the comparable rates in North America. (Source)

- The fear of a recession caused by rising rates that slow economic growth sufficiently to shrink inflation is the major concern for markets. Equity markets dropped immediately following the Fed’s announcement and accompanying commentary, and on the following day more than 90% of S&P 500 stocks dropped as the overall index fell more than 1%. (Source)

What’s ahead for this week?

- In Canada, after a slow week for economic announcements last week, three important indicators are scheduled for release: October’s retail sales and Gross Domestic Product, and November’s Consumer Price Index.

- In the U.S., November’s building permits, new home sales, existing home sales and durable goods orders, December’s consumer confidence, and third quarter’s GDP data will be released.

- Globally, no major economic announcements are planned.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.