IAIC Market Update - April 4, 2022

Last Week in the Markets: March 28th – April 1st, 2022

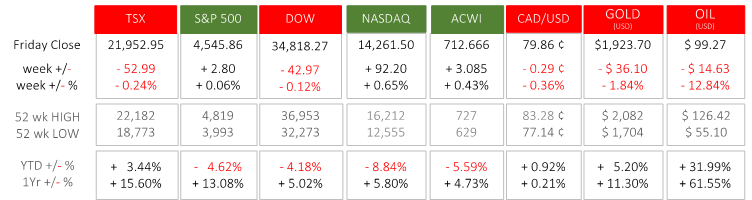

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Equity markets were mixed based on a blend of positive and negative news locally and internationally. Inflation, and actions to control it, continue to be the primary driver of markets.

- The price of oil fell last week, however, is up 32% this year and 62% from one year ago. Higher energy prices will filter through the economy and add to already rapid price increases.

- Central banks anticipate rising inflation and will raise short term interest rates.

- Canadian Gross Domestic Product rebounded in February with 0.8% growth following January’s Omicron-induced results of 0.2%. The strengthening economy coupled with jobs growth (report scheduled for Friday), and rapidly rising prices that are expected to continue to rise, forces the Bank of Canada to trim back economic growth with higher interest rates at their next meeting in mid-April. (Source1, Source2)

- The same economic situation exists in the U.S. (rising inflation, strong employment, GDP growth) except the next meeting of the Federal Reserve’s Open Market Committee is scheduled for early May. President Biden has taken the unusual step to release 1 million barrels of oil daily for the next six months from strategic reserves, which illustrates many inflation-fighting actions are possible.

- Underlying the mixed news and data is the geopolitical situation emanating from Ukraine’s invasion by Russia. The disruption of energy shipments to western Europe, the rising cost of manufacturing inputs like electricity generated from natural gas, fiscal pressures for governments to increase military spending, and support for refugees will affect markets around the world.

What’s ahead for this week?

- In Canada, February’s building permits and merchandise trade balance will be announced prior to the federal budget on Thursday at 4 pm Eastern. On Friday the February jobs report will be released.

- In the U.S., factory orders, goods and services trade deficit, consumer credit and wholesale inventories for February, and Purchasing Managers Indexes from ISM and Markit for March will be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.