IAIC Market Update - April 3, 2023

Last Week in the Markets: March 27th – 31st, 2023

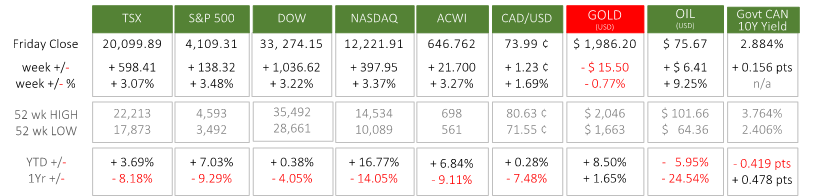

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The end of the week, March 31st, coincided with the end of the first quarter of 2023. For equity investors, the final few days of trading reversed much of the recent losses that began with two bank failures in the United States. Each of the North American indexes gained more than 3% last week, and they all sit in positive territory for 2023. Unfortunately, each of them is below their levels of one year ago by four to fourteen percent.

- The NASDAQ has jumped nearly 17% this quarter and this year as technology firms are seeing their reductions in staffing and other cost cutting measures reflected positively in their share prices. The broader indexes, like the TSX and S&P 500, have been weighed down by the Financials sector in each.

- One of the contributors to last week’s increases for equities was the release of the February’s U.S. Personal Consumption Expenditures (PCE) price index on Friday. Core PCE increased 4.6% on a year-over-year basis, a slight deceleration from the level in January. In February the PCE rose 0.3% from its level in January. Both increases were below expectations, which led to increases across equities.

- Positive news for the Canadian economy arrived with the release of January’s Gross Domestic Product (GDP) numbers that saw a monthly growth of 0.5%.

Sources:

Fed Inflation Gauge,

Personal Income and Outlays,

Business Economy GDP

What’s ahead for this week?

- In Canada, the Bank of Canada’s Business Outlook Survey will be released. Also, imports, exports and trade balance, and the latest jobs data, including employment change, unemployment rate, and labour participation rate are scheduled prior to the Good Friday holiday.

- In the U.S., several indicators will be reported: durable goods, factory orders, construction spending, imports, exports, trade balance, mortgage index and refinance rate, and energy stockpiles and inventories. On Good Friday when markets are closed Nonfarm Payroll report will be issued.

- Globally, imports, exports and trade balances are expected from Germany, France and Italy, and Purchasing Managers Indexes for products and services for the Eurozone and U.K.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.