IAIC Market Update - April 12, 2021

Last Week in the Markets: April 5th - 9th, 2021

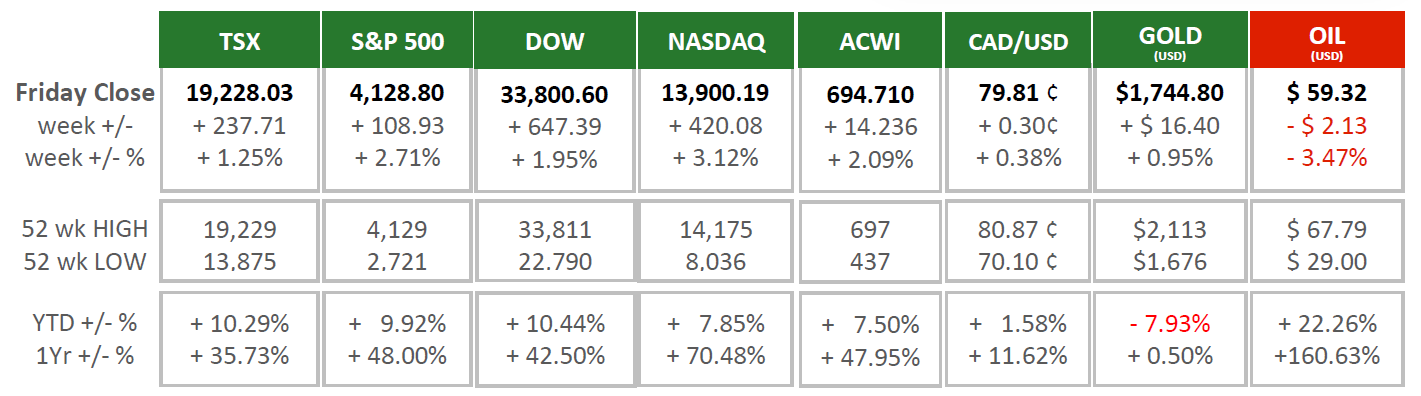

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The week ended very positively for North American and global equity investors. The broad-based indices of the TSX, S&P 500 and MSCI’s All-Country World Index achieved record highs. A number of contributing elements played a part:

- The US employment report that was released on Good Friday provided a positive start to the week. The same report for Canadian jobs exceeded expectations for employment and job creation.

- Purchasing Managers Indices (PMI) for services companies indicated an increasing optimism for economic growth. The perspective of corporate purchasers is a strong leading indicator of future economic activity.

- Minutes from the latest Federal Reserve meetings reconfirmed their commitment to low interest rates.

- The International Monetary Fund (IMF) increased its forecast for overall global growth to 6% from 5.5%

- With a drop in the value of the U.S. dollar, commodity prices rose, except for oil. Foreign exchange influences also lifted the materials sectors within the indices as metals rose.

- The largest technology firms also rose; Amazon, Apple, Microsoft, Alphabet (Google) and Facebook that comprise one-fifth of the S&P 500, contributing strongly to overall record highs.

What’s ahead for this week?

- In Canada, the Bank of Canada will release its latest business outlook, which influences its future monetary policy. Also, February’s manufacturing sales and new orders, and March’s existing home sales and average prices from the red-hot housing market will be announced.

- In the U.S., March inflation numbers will be released through the Consumer Price Index (CPI), as will the budget deficit, retail sales and industrial production. The Federal Reserve Chair, Jerome Powell, will speak at the Economic Club of Washington, where he is expected to continue his organization’s strong support of recovery.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.