IAIC Market Update - March 27, 2023

Last Week in the Markets: March 20th – 24th, 2023

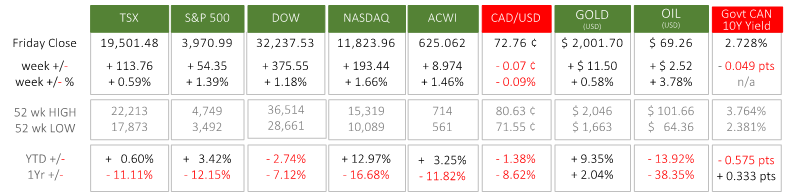

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indexes delivered positive, overall returns last week, and the S&P 500 and NASDAQ achieved this feat for the second consecutive week. Financial firms, primarily banks, continue to lead the news cycle with Credit Suisse, Deutsch Bank and others revealing vulnerabilities. The TSX Financials sector is down about 11% since its most recent peak in mid-February.

- Rising interest rates and insufficient oversight have led to the failures of Silicon Valley Bank and Signature Bank. With rates rising for the past year, a few banks had the cash demands of paying higher short-term rates collide with the long-term, low interest their investments are earning. Thankfully the Canadian financial services sector is much more heavily regulated than American and European institutions.

- The crisis for some banks has affected the U.S. Federal Reserve’s ability to fight inflation. Typically, a central bank will slow demand in the economy by reducing liquidity in the system by raising rates and reducing bond holdings. On Wednesday the Federal Reserve increased its benchmark, federal funds, rate by ¼ point, which is a smaller increase than forecast just a few weeks ago.

- On Tuesday StatsCan released the Consumer Price Index (CPI) for February which showed an increase of 5.2% on a year-over-year basis. A month earlier, January’s annualized inflation was 5.9%. Although the inflation rate has fallen from its peak and continues to lower, it is due to steep monthly price increases one year ago that have adjusted the baseline upward. Groceries prices continue to drive overall inflation after posting a rise of 10.6% since February 2022.

Sources:

TSX Financials Sector,

Fed's inflation and bank crisis,

CBC explainer Canadian banks,

Fed press conf, release and SEP,

StatsCan

What’s ahead for this week?

- In Canada, after last week’s consumer inflation release another significant economic release, January’s Gross Domestic Product, measuring the economy’s overall health will be reported.

- In the U.S., the House Price Index, pending home sales, goods trade balance, retail inventories, real consumer spending, personal income and spending will be released. Fourth quarter GDP, GDP Price Index and GDP Sales, and the Fed’s primary inflation indicator, the Personal Consumption Expenditures (PCE) price index and are scheduled toward the end of the week.

- Globally, following the takeover of Credit Suisse by UBS, European news continues as Germany, France and Italy release their Consumer Price Index for their individual countries, and the entire Eurozone also reports aggregate CPI. Eurozone business climate, inflation expectations and employment are also due.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.